YOU MUST KNOW..Why Do Businesses Get Audited

So why do companies get audited. Why does insurance get audited Business insurance policies like general liability workers compensation and your short-term disability policies will get audited on an annual basis.

Internal Audit Report Flash Report For Capgemini Consulting Digitally Transforming A Retail Bank Internal Audit Audit First Date Tips

Answer 1 of 13.

Why do businesses get audited. Since this statement the Criteria has been altered meaning that in order to require an audit a company must fit 2 out of 3 requirements these are. Make sure youre part of the 99 that dont. More than 50 employees.

The results are reported in a written audit opinion and the language in the opinion defines an audit. Each type is considered by the accounting industry as being more reliable than the one below. The single biggest reason why the IRS audits a company is because it suspects that the firm isnt being too honest about its income and thus paying less tax than it should.

Why do small businesses get audited. Audits help businesses uncover problems and ensure efficiency. LLC shines a little light on how and why businesses are chosen for a sales tax auditThis presentation is part of t.

Why Do Businesses Get Audited. To insure the effective operation of an organization. As you get higher on the list the cost of each goes up.

Does every company get audited. Even if its not required a financial audit might make obtaining a loan easier and help lower interest rates. Audits can be especially scary for small- or midsize-business owners because of the prospect of owing more taxes on a limited budget or being held personally liable without an experienced accounting department to back you up.

Being selected for audit does not mean you violated any laws or rules. Its worth noting though that you can be audited for reasons beyond your control. Believe it or not only about 25 of small business owners will be audited so it can feel like theres a bullseye on.

There are four kinds of financial statements. If youre not a public company your investors banks or VCs may require an audit be performed because the auditor gives an independent opinion on whether the financial health of the company as reported by management is a fair presentation of its position assets liabilities. They are auditable policies and its because the way these insurance policies are rated is based on different variables that could change on an annual basis.

The IRS is quite serious when it comes to such claims and even the slightest suspicion of tax. Your carrier assigns a premium based. Investors may also demand an audit.

When Should Your Business Get Audited Financial Statements. 1 Internally prepared 2 CPA compilation 3 Reviewed and 4 Audited. Public companies sell their shares of stock to investors and must be audited by independent auditors.

Failing to follow filing requirements and meet deadlines triggers. As the others have pointed out lenders often demand a company be audited as a term of lending money to them. Are you wondering Why is the insurance company auditing my business As a business owner do you have to comply with insurance company audits.

If an auditor finds questionable business practices the. It exposes hidden income. The main reasons for the audit are to provide reasonable assurance that the financial statements are free from material misstatements and errors and to ensure that all events that can adversely affect the company have.

A business audit is a documented evaluation of whether or not a companys financial statements are materially correct along with the standards evidence and assumptions used to conduct the audit. We typically request three years worth of records. Has your insurance carrier audited your company.

AN EXTERNAL AUDIT IMPROVES INTERNAL SYSTEMS AND CONTROLS Auditors do not just focus on the. When you get a commercial insurance policy in many cases premium assigned isnt final. To review compliance with a multitude of administrative regulations.

Non-profits may be required to get them under the terms of their grants. Some lenders require an audit to determine eligibility for bank loans lines of credit and other types of loans. One in 100 businesses gets audited each year.

The IRS uses random selection to audit some returns and your return can also be. We audit employers records to ensure that wages and hours are accurately reported as required by Washington States unemployment-insurance laws and rules. In this article well look at six of the top reasons small businesses get audited along with tips on how to avoid becoming one of them.

Dan Thompson from Thompson Tax Assoc. With more and more companies falling out the audit regime following the increase in the audit thresholds what are the benefits of having a voluntary audit. Why do small private companies need to be audited.

The new requirement is welcome news to many businesses that will save money due to not fitting the new criteria. Do you know what percentage of small businesses get audited. If the business cannot satisfy three years of profits in a five-year period you are likely to get audited so its advisable to follow the IRS publication 535 guide for business expenses Itwaru says.

Consistent late filing of tax returns and payment of taxes. Our clients often wonder whether or not theres any truth to the idea that there are certain small business IRS audit triggers. One of the top reasons small businesses conduct financial audits is to obtain or renew a loan.

Here are the top 5 reason to conduct an audit. A turnover of more than 65m. Assets of more than 326m.

To instill a sense of confidence in management that the business is functioning well and you are. Its actually an estimate.

Pin By Tina Greenlee On Class Project Internal Audit Business Management Degree Business Classes

6 Reasons Why Businesses Get Audited And How To Avoid Them

Audit Your Bank Account The Bossy House Audit Bank Account Accounting

6 Reasons Why Businesses Get Audited And How To Avoid Them

Internal Control System In Accounting Internal Audit Internal Control Business Management

Guide To Being Audited By The Irs Small Business Infographic Irs Audit

Internal Audit Roadmap Thomson Reuters Accelus Internal Audit Roadmap Infographic Roadmap

Top Six Reasons Why Businesses Should Outsource Their Payroll Payroll Payroll Accounting Accounting Services

Would Your Business Survive An Audit Tax Quote Business Tax Small Business Tax

4 Benefits Of External Auditing Auditor External Infographic

Inventory Audit Procedures Audit Procedure Inventory

It Services Support For St Charles County Mo Managed Computer Services Small Business Tax Business Tax Audit

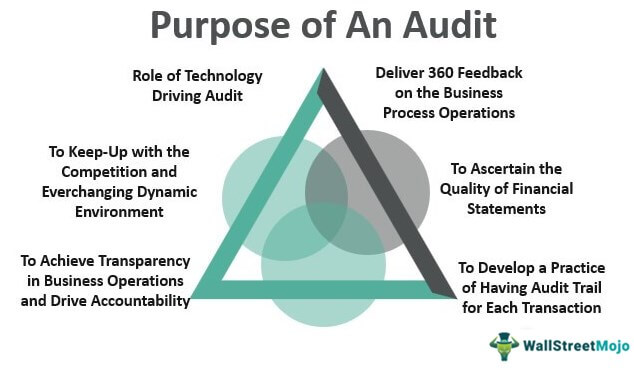

Purpose Of An Audit List Of Top 10 Purpose Of Audit Procedures

What Is An Audit Everything About The 3 Types Of Audits Ageras

Dont Get Audited How Your Side Gig Needs To Handle Taxes Financedebt Side Gigs Credit Card Debt Relief Finance Debt

Audit What Is Business Audit Review Program And What Does It Mean For Any Small Business

If You Get Audited By The Irs What Happens Insight Into Irs Audit

Small Business Owners Are 940 Percent More Likely To Get Audited Taxfact Small Business Tax Business Tax Small Business Owner

Factors That Trigger An Irs Audit Infographic Irs Audit Tax Guide