OH MY GOD! Why Am I Not Eligible For Electronic Filing

The payment is not available for deceased individuals using a single filing status and without a qualifying child. Form 990 and 990-PF filings for tax years ending on or before June 30 2020 may still be on paper.

Ad Still Have Taxes to File.

Why am i not eligible for electronic filing. In the event you do not qualify to file for free with any of the software providers but have less than 69000 in adjusted gross income you can still file for free with the IRS but in your case you will need to do so using the online fillable forms here. To e-file your tax return youll need to submit all your W-2 information electronically. The following is a list of forms available in UltraTax1040 that are not eligible for electronic filing.

Ad Didnt file a tax return. EY TaxChat Can Help You File Your Complicated Taxes. Filing this way will not support state forms or e.

Territories you cannot apply for an EIN online. Let TaxChat Professionals File Your Extended Taxes For You. You may have had taxes withheld from your unemployment but that is not the same as having taxable income.

The following returns are eligible to be filed electronically but you must still confirm that the option you choose supports the returns you want to file. You are NOT eligible. Here is some information on how to file your state and federal taxes for free in 2021 for the 2020 tax filing yearSee more updated tax guides here.

These forms would disqualify a return from electronic filing eligibility. You may be eligible to claim stimulus payments other refundable tax credits from the IRS. If a taxpayer e-signs the form in the physical presence of the ERO and the taxpayer has a multi-year business relationship with the ERO.

Returns eligible for electronic filing. While this Access code is not mandatory if you do not enter your Access code you will not. Review says not eligible for electronic filing.

However the IRS doesnt endorse or approve any particular software for IRS e-file. Instead it will reject it if the sum of your W-2 wages is more than the amount you report on the return. You can still claim Tax Credits or your missing stimulus pymts.

Contain a W-2 where box 1 is blank or the box 16 amount is greater than the box 1 amount. In the case of a short tax year or certain other circumstances detailed in the 990 or 990-PF Instructions. Identity verification must be completed every time a taxpayer electronically signs Form 8878 or 8879 with two exceptions.

Which forms in UltraTax1040 are not eligible for electronic filing. You may be eligible to claim stimulus payments other refundable tax credits from the IRS. Not eligible for electronic filing.

Ad Quickly Prepare and E-File Your Federal and State Income Taxes. If you were incorporated outside of the United States or the US. Either way well help you see if you.

The IRS will not reject your return because the total income you report on the return doesnt match the amounts on your W-2. Update March 24 2021. Please call us at 267 941-1099 this is not a toll free number.

Have no taxable income. Returns cant be e-filed if they. You may have taxable.

Ad Didnt file a tax return. Incarcerated eligible individuals Incarcerated individuals that use the. The IRS has partnered with many companies to provide electronic filing to the public.

I made the mistake of already going through the credit card portion before I realized that it wouldnt let me efile. Its Not Too Late to File. For the 2020 tax year prior to filing your tax return electronically with NETFILE you will be asked to enter an Access code after your name date of birth and social insurance number.

If you have a form not available for e-filing or you your spouse or dependent has an invalid Social Security number SSN you cant e-file your return. When I look at the review. Your eight-character Access code is made up of numbers and letters and is located on the right side of your Notice of Assessment for a previous tax year.

Determining exactly how many taxpayers are eligible for but not using Free File is almost impossible. The IRS said it does not have data on filing fees paid by taxpayers. If you requested an electronic funds withdrawal on your original electronic return we recommend you file your Amended return after the date of withdrawal on your original filing.

Ad E-File Your Taxes for Free. You can still claim Tax Credits or your missing stimulus pymts.

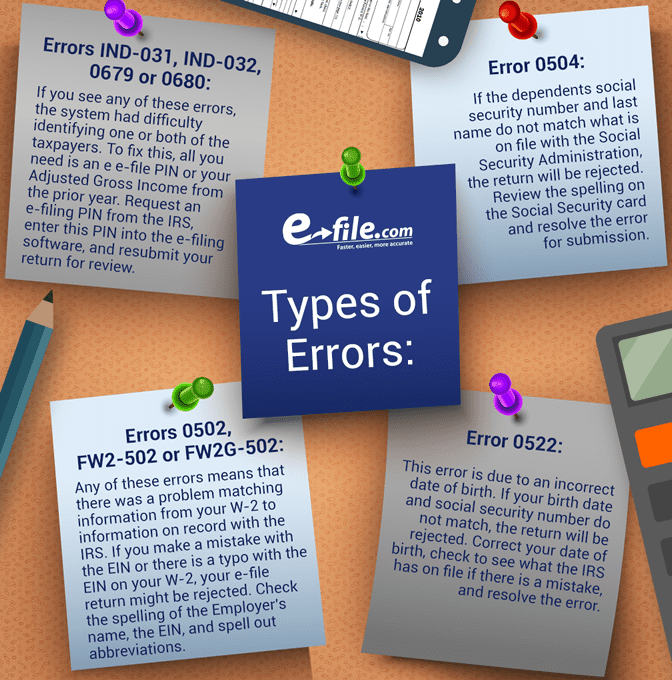

How To Correct An E File Rejection E File Com

Income Tax India On Twitter On Consideration Of Difficulties Reported By Taxpayers Other Stakeholders In Electronic Filing Of Certain Forms Under The It Act 1961 Cbdt Has Further Extended The Due Dates

Don T File A Paper 2020 Federal Tax Return If You Don T Have To Irs

Court Filing And Efiling Servenow Com

Atf Eform 1 Electronic Filing Guide Quietbore Com

Notice Of Electronic Filing Wikipedia

Free Electronic Filing Department Of Revenue

The Most Common Causes Of E Filing Problems

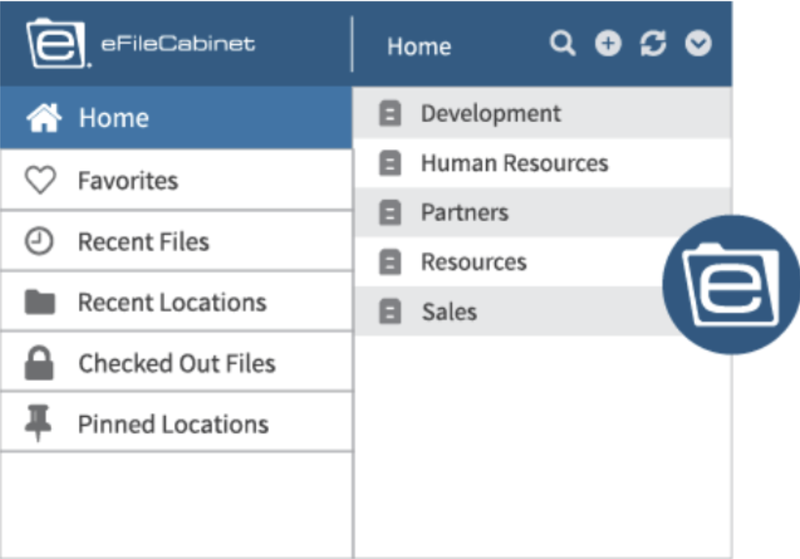

How To Organize An Electronic Filing System Electronic Filing System Digital Filing System Electronic Organization

How To Set Up An Electronic Filing System In 2021 The Blueprint

Tax Return Refund Deposit Options Explore The Best Payment In 2021 Tax Deadline Estimated Tax Payments Tax Extension

How To Correct An E File Rejection E File Com

Eoir Courts Appeals System Ecas Online Filing

Electronic Filing Snohomish County Wa Official Website

How To Set Up An Electronic Filing System In 2021 The Blueprint

Notice Of Electronic Filing Wikipedia