Useful! Why Is The Gold Silver Ratio So High

Louis Cammarosano Leave a Comment. Full and Partial Demonetization of Both Metals is to Blame.

Real Interest Rates And Gold Explained Sunshine Profits

What happened with the Gold-Silver Ratio following the US Civil War.

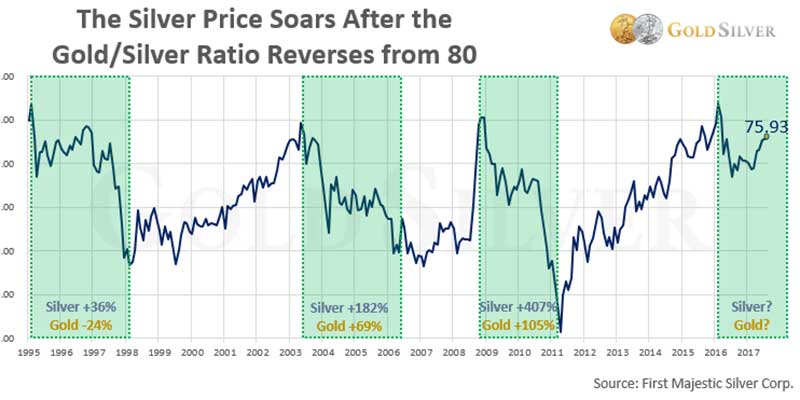

Why is the gold silver ratio so high. Where gold goes silver follows. The chart below explains how silver has underperformed gold on COMEX. If you bought silver back then you made a ton of money in a few short months.

The Gold-Silver Ratio has gotten as high as over 100 oz of silver to buy 1 oz of gold in the 1930s as the US government forced US citizens to turn in their gold coin savings. The gold-to-silver ratio which indicates the relative strength of the two metals is testing the three-decade-high level of 100 seen in February 1991. Historically the ratio is about 45 ounces of silver to one gold ounce.

For those who monitor the. While gold is down by 67 per cent silver is down by 1437 per cent. This is a physical ratio 12 to 95 119 gold to silver.

So the gold-silver ratio tends to go higher than during these times. The reason for that is silver is used mainly as an industrial. It can also be used as a way to determine when it is better to buy silver and when it is better to buy gold.

When the ratio is high the general consensus is that silver is favored. Now lets say youre finding 95 lbs of silver and 12 lb of gold in a 10lb scoop of mined metal. Free shipping on orders 199.

Ad Buy Gold Silver At JM Bullion. The physical ratio is 19 gold to silver so that could imply a price point GSR or 91. Viewing the gold to.

Last night we discussed how to get silver at the spot price. In the past whenever the ratio has increased to a very high level it has never sustained and fallen. Historical context illustrates just how out of kilter such a ratio is.

While silver has weakened relatively more due to its stronger sensitivity to emerging markets EMs. In 1914 as WWI began the gold to silver ratio was 41-1 by the end of the war the ratio was 15-1. The average since January 1990 is about 65.

Also included in this report is the Open Chat Friday You tube we did with the Smaulgld Mug. Many large-scale experienced investors may trade their silver for gold as the ratio drops. Some say the ratio was inspired by cosmic movements and the position of the sun and moon which were believed to be extraterrestrial counterparts of gold and silver respectively.

In July 2003 the gold to silver ratio was 77-1. The following chart covers the past 300 years of the Gold-Silver Ratio. Ad Shop a wide product range from the worlds most reputable brands.

A more popular explanation for the 10 to 18 ratio however concerns the relative supplies of each metal. So in 1992 it took about 92 ounces of silver to buy an ounce of gold. Best Prices Secure Free Shipping.

Conversely a low ratio tends to favor gold and may be a signal its a good time to buy the yellow metal. In 1975 in the midst of an oil crisis the gold to silver ratio was 40-1 by 1979 it was at 14-1. The ratio rises when silver underperforms gold.

BBB A rated dealer for over 10 years. Why the Gold Silver Ratio is so High. A higher ratio means silver is undervalued compared to gold.

In 1941 the early end of WWII the gold to silver ratio was 96-1 by 1967 it was once again 16-1. Why does the silver to gold ratio remain so highGet your Silver Fortune silver bar here. In early 2020 the global COVID-19 outbreak caused a sharp decline in economic activity causing a sharp.

Smaulgld Live Stream and Interviews March 7-9 2019. Today the ratio sits at 926 the highest value since March 1993. However gold can either rise or fall less rapidly on the back of safe-haven demand.

Conversely a lower ratio means silver is overvalued compared to gold. Weakness in gold can be attributed to currency depreciation in the emerging markets. This is because relative to the ratio silver is somewhat cheap.

Gold Silver Ratio 300 Year Chart. Currently the ratio is at 965. Looking ahead The goldsilver ratio is likely to remain historically high over the short to medium term says Metals Focus because the ratcheting up of US trade tensions both with China and Mexico has further encouraged professional investors to either cut their long exposure to silver or to bet on further price weakness using derivatives on the Comex exchange.

The high ratio of gold price to silver price suggests a world with a lot of worried rich people and a so-so economy but in which crisis fears have not risen to the level that the demand for portable anonymous hard assets has risen to the level or affected enough less-wealthy people to create a. New deals every week. As of this writing the current gold to silver ratio still sits at about 1151 which means that you would need 115 ounces of silver to equal 1 ounce of gold down from a high of nearly 1251 on Monday morning on March 16th.

The value of gold and silver bullion has generally risen and fallen in relative tandem over time.

Gold To Silver Ratio Spikes To Highest Level In 27 Years Seeking Alpha

How Rare Are Gold And Silver Silver Bullion

The Longest Record Broken Gold Silver Ratio Hits Highest In Over 5 000 Years Nasdaq

What Is The Gold Silver Ratio Retirement Living 2021

The Longest Record Broken Gold Silver Ratio Hits Highest In Over 5 000 Years Nasdaq

Precious Metal Prices Expected To Be Lower In 2021

What Is The Gold Silver Ratio Retirement Living 2021

A Historical Guide To The Gold Silver Ratio

Gold Vs Silver As Precious Metal Investments

Silver Manipulation Explained Sunshine Profits

Gold To Silver Ratio Spikes To Highest Level In 27 Years Seeking Alpha

The Longest Record Broken Gold Silver Ratio Hits Highest In Over 5 000 Years Nasdaq

Extraordinary Extreme Gold Silver Ratio Of 84 4 Is Highest Since 2008

The Longest Record Broken Gold Silver Ratio Hits Highest In Over 5 000 Years Nasdaq