Useful! Why Am I Not Paying Tax In My New Job

To avoid paying too much tax you can ask HMRC to split your personal allowance between your jobs. Ad A Tax Agent Will Answer in Minutes.

Starting a new job or interested in.

Why am i not paying tax in my new job. The OP will start paying tax when their YTD taxable pay exceeds their YTD tax. Ad Didnt file a tax return. You can still claim Tax Credits or your missing stimulus pymts.

If you think the P45 has not been processed correctly then you should take this up with your employers. Am I on the wrong tax. Your state benefits change.

As the new tax year has just started if you finished your last job before 5th April your P45 will most likely not matter. Ive just got my first pay check and I have a net pay of almost 1700 for this month. If theres nothing left you should not be paying tax and may be due a refund.

You may be taxed on a temporary basis called emergency tax if you are changing job or starting work for the first time and your new employer does not get your RPN. 151110 - 1240 7. Based on this the IRS put out a new Form W-4 for 2020.

Ad Didnt file a tax return. What action should I take. With respect to payroll when you start - if you havent given them a p45 or filled.

The employer hasnt done anything wrong - they have applied a standard cumulative tax code. You might have claimed to be exempt from withholding on your Form W-4. Ad A Tax Agent Will Answer in Minutes.

I dont understand why ive not been taxed. Registering your new job. Where your new employer does not notify Revenue that you have started you can use myAccount to register your new job.

You may be eligible to claim stimulus payments other refundable tax credits from the IRS. My employer pays me weekly This means my weekly tax-free allowance is 22115 11500 52 3. State benefits are not taxed however they often take up part of your Personal Allowance which can impact your tax code.

Contact the Income Tax helpline if youre not already paying tax. Though Social Security and Medicare exemption are uncommon you are excluded in certain situations such as if you are a state or local government employee with a pension plan or a nonresident alien with a certain type of visa. If you have worked in Ireland previously you must provide your employer with your PPSN.

The old withholding form no longer accurately predicted how much federal income tax should be withheld from your paycheck. Go to PAYE Services and select Update Job or Pension Details. You have been put on emergency tax by the sound of it check with your.

If My Job Did Not Take Out Federal Income Taxes Does That Mean I Pay. I graduated earlier this year and have started a job which pays a salary of 18851. My Tax Code is 1150L This means my annual tax-free allowance is 11500 1150 x 10 2.

To add a new job or pension you will need. Your personal allowance will normally only apply to your main job. Questions Answered Every 9 Seconds.

Their earnings last year are irrelevant to the current tax year. You can still claim Tax Credits or your missing stimulus pymts. Insufficient federal income tax withholding can happen if youre married and you and your spouse both work but you didnt complete the Two EarnersMultiple Jobs Worksheet on page 2 of Form W-4.

I concur that your net pay may go down in April if you did not earn enough in the previous tax year to pay any tax. Social Security limits payroll taxes to the first 110100 of your income -- the wage base limit Any income above this amount is not subject to Social Security tax although it is still subject. You may be receiving your tax-free personal allowance more than once and so underpaying tax or you may be paying too much tax.

Your job is not registered with Revenue. The unused allowance for the year to date is accumulated on his first payslip - this is the amount we are all allowed to earn before paying tax. Are still expected to pay taxes throughout the year not just at tax time.

If you give your employer your PPSN You. How the tax is calculated The first 22115 I earn is entirely tax. One possible error is receiving too much tax-free pay in the month in which you change jobs.

If theres anything left youre a taxpayer. If this does not resolve the. The system sounds simple but things can go wrong.

If your husband has had a gap. For example if you. Your new employers tax.

HMRC may not catch up with this until the end of the tax. You may be eligible to claim stimulus payments other refundable tax credits from the IRS. You must meet certain requirements to be exempt from withholding and have no federal income tax withheld.

If the benefits you receive change then. If you do not have a PPSN contact the Department of Social. Questions Answered Every 9 Seconds.

Self Employed Tax Calculator Small Business Bookkeeping Business Tax Self Employment

File Itr Now Income Tax Return Tax Return Income Tax

Everything You Need To Know About The 2021 Tax Deadlines Forbes Advisor

/GettyImages-1017224516-ef0a6e46e93d4073b119d933a9b3f11c.jpg)

Do Non U S Citizens Pay Taxes On Money Earned Through A U S Internet Broker

Why Amazon Paid No Federal Income Tax

What Age Can You Stop Filing Income Taxes

Paying Tax On Stock Options A Guide For Canadians By Stern Cohen

Us Citizens Living Abroad Do You Have To Pay Taxes

Do I Have To Pay Taxes On Lottery Winnings Credit Karma Tax

Its Tax Times Some Funny Tax Quotes That Will Tickle You Tax Quote Funny Dating Quotes Taxes Humor

What To Do If You Owe The Irs Back Taxes H R Block

How Bonuses Are Taxed Turbotax Tax Tips Videos

Foreign Earned Income Exclusion And Us Or Irs Tax Returns

Why Do You Have To Pay Taxes Wonderopolis

Pin By Jacie Robinson On Jobs Paying Taxes Property Tax Inspirational Quotes

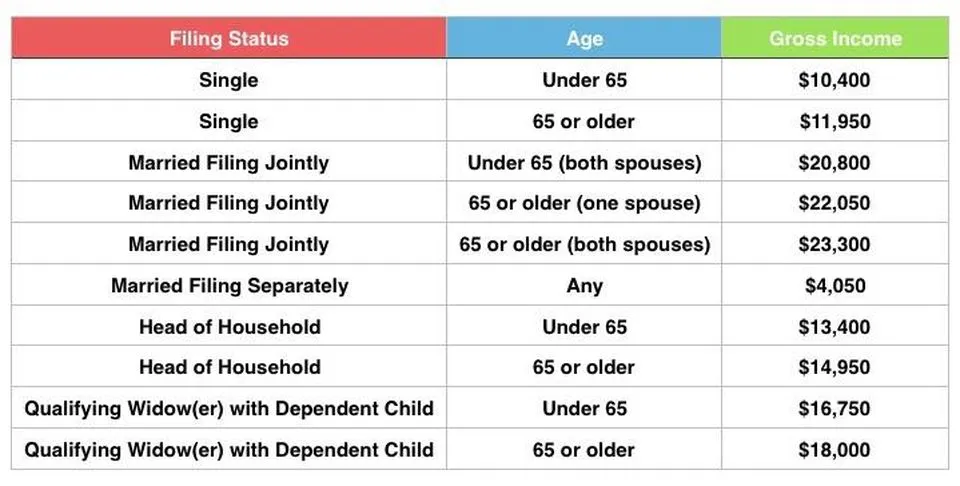

How Much Money Do You Have To Make To Not Pay Taxes

How Much Do You Have To Make To File Taxes H R Block