OH MY GOD! Why Are Aclu Contributions Not Tax Deductible

Contributions to the American Civil Liberties Union are not tax deductible. NOW Foundation is a 501c3 organization with a 501h election.

Dorothy M Ehrlich Deputy Executive Director ACLU 561188.

Why are aclu contributions not tax deductible. Anthony D Romero Executive Director CEO ACLU 436653. You can read all about it on this page of the ACLUs website. A donor who chooses to Join and become a card-carrying member of the ACLU is making a contribution to the American Civil Liberties Union.

A donor may make a tax-deductible gift only to the ACLU Foundation. Membership dues and other gifts to the American Civil Liberties Union are not tax deductible. The ACLU is a 501c 4 nonprofit corporation but gifts to it are not tax-deductible.

Gifts to the ACLU Foundation are tax-deductible to the donor to the extent permissible by law. These dues and other gifts to the American Civil Liberties Union are not tax-deductible. A donor may make a tax-deductible gift only to the ACLU Foundation.

If you have an ActBlue Express account we make it easy for you to find your charitable contributions made through our platform. Geri E Rozanski Director. They also enable us to advocate and lobby in legislatures at the federal and local level to advance civil liberties.

Making a gift to the ACLU via a wire transfer allows you to have an immediate impact on the fight for civil liberties. Gifts to the ACLU Foundation are fully tax-deductible to the donor. How much does Anthony Romero make.

When you make a contribution you become a card-carrying member of the ACLU and the ACLU of Texas and the gift is not tax-deductible. The ACLU 50-State Survey. The American Civil Liberties Union whose mission is to defend the Constitutional civil liberties of Americans is a 501 c 3 organization.

ACLU Membership not tax-deductible Join the ACLU of Texas a 501c4 non-profit or renew your membership. Your membership dues support our legislative advocacy and lobbying work. My wife and I receive bulk-mail political fundraising pitches disguised as surveys all the time --.

ACLU-TN is composed of two separate organizations. However donations to ActBlue Charities and other registered 501 c 3 organizations are tax deductible. Membership dues and other gifts to the American Civil Liberties Union are not tax deductible.

The main ACLU is a 501c4 which means donations made to it are not tax deductiblethough you do get a nifty membership card if you donate there. More Ways to Give See the ACLUs grade A rating on Charity Watch The ACLU is an accredited charity approved by the Better Business Bureau. Make your tax-deductible gift today and help us fight alongside people whose rights are in severe jeopardy.

ACLU monies fund our legislative lobbyingimportant work that cannot be supported by tax-deductible funds. You can also mail in your membership form to the ACLU office at. The ACLU Foundation is a 501c3 nonprofit which means donations made to it are tax deductible.

When you make a contribution to the ACLU you become a card-carrying member who takes a stand for civil liberties. This is because donations in support of legislative advocacy supporting specific bills that enhance civil liberties protections or opposing bills that seek to erode them are not tax deductible. Your membership dues support our legislative advocacy and lobbying work.

When you make a contribution you become a card-carrying member of the ACLU and the gift is not tax-deductible. ACLU monies fund our legislative lobbying--important work that cannot be supported by tax-deductible funds. Donations are not tax deductible to the giver.

Gifts to the ACLUs Guardian of Liberty monthly giving program are not tax deductible. Once youre logged in you will immediately see the History page which. Make a tax-deductible.

Donations to the ACLU are not tax-deductible because the organization engages in legislative lobbying. Membership dues for donors who join and become card-carrying members of the ACLU are gifts to the American Civil Liberties Union. Both the ACLU of Tennessee and its affiliated ACLU Foundation of Tennessee are non-partisan non-profit organizations dedicated to protecting the liberties and rights guaranteed by the United States Constitution the Tennessee Constitution and local state and federal human rights laws.

It is the membership organization and you have to be a member to get your trusty ACLU card. These organizations are not considered to be charitable organizations under the regulations - that section of the Code is 501 c3 - and therefore contributions made to the ACLU are not deductible as charitable contributions. The ACLU is a 501 c 4 nonprofit corporation but gifts to it are not tax-deductible.

The ACLU actually has two arms the lobbying organization and the foundationand particularly if you itemize your taxes it pays to be aware of the difference. Contributions to candidates and parties and to other entities with the intention of influencing elections are not deductible. It is the membership organization and you have to be a member to get your trusty ACLU card.

For your donation to be counted as tax-deductible it must. Gifts to the ACLU Foundation on the other hand are deductible because that arm of the organization engages solely in legal representation and communications efforts. The American Civil Liberties Union.

A donor who chooses to Join and become a card-carrying member of the ACLU is making a contribution to the American Civil Liberties Union. The main ACLU is a 501c4 which means donations made to it are not tax deductiblethough. The organization pays not tax on income related to its tax-exempt purpose.

As other answers have noted the ACLU proper is a tax-exempt organization per section 501 c4 of the Internal Revenue Code. For more details please email us. The IRS provides that an organization under this status may spend up to 100 percent of its time lobbying.

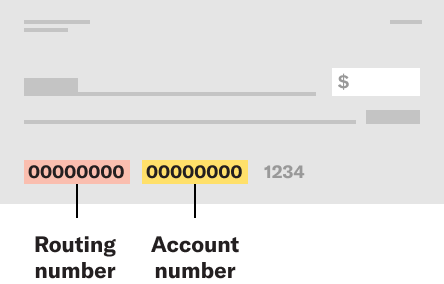

Depending on how you donate your gift may or may not be tax deductible. While you may think of the ACLU as one giant nonprofit the IRS does not. Contributions to the ACLU are not tax deductible.

Is not a 501c3 organization. While not tax deductible they advance our extensive litigation communications and public education programs.

Aclu Donations How To Make A Tax Deductible Gift Money

2017 Year In Review Aclu Of Connecticut

Moaa What You Should Know About A New 300 Charitable Tax Deduction

Icymi Strategies To Increase Sustainer Donations Jackson River

Update Your Monthly Commitment To The Aclu American Civil Liberties Union

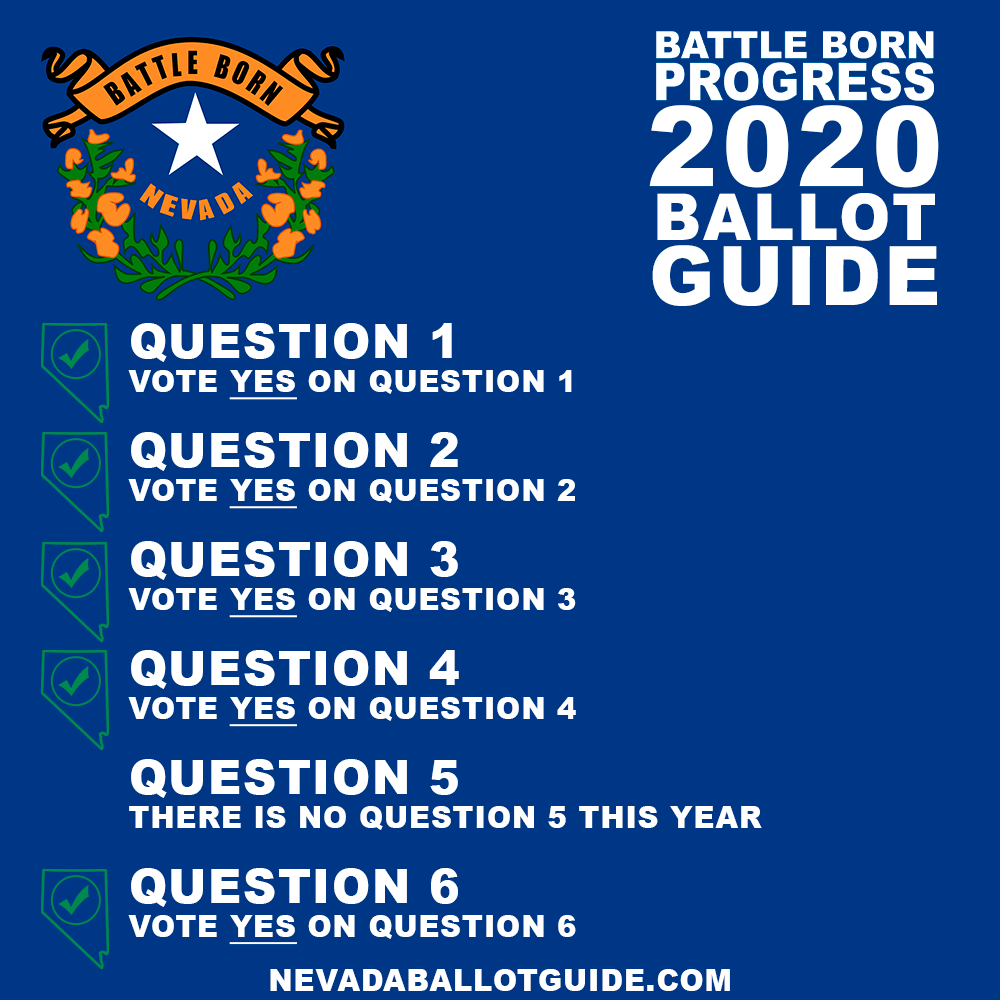

Battle Born Progress Launches Ballot Guide Supporting Yes Votes On Every 2020 Ballot Question Battle Born Progress

Update Your Monthly Commitment To The Aclu American Civil Liberties Union

The Millionaire S Tax A Fair Step Toward Tax Justice Mlpp

Transformational Public Safety Reducing The Roles Resources And Power Of Police News Commentary American Civil Liberties Union

Uig Live Free Not Broke Webinar Starting In 1 Hour At 10 Am Cst Find Out How You Can Save Money Earn Money And Change Your Financia Earn Money Tax Money Uig

Renew Your Aclu Membership American Civil Liberties Union

American Civil Liberties Union

Tax Deductions Business Tax Tax Deductions Direct Sales Business

Standard Deduction 2020 2021 What It Is And How It Affects Your Taxes Wsj

Donate To The Aclu Of Florida Aclu Of Florida We Defend The Civil Rights And Civil Liberties Of All People In Florida By Working Through The Legislature The Courts And