WONDERFUL! Why Would The Irs Send Me A Certified Letter

To get a copy of your IRS notice or letter in Braille or large print visit the Information About the Alternative Media Center page for more details. One example is when a taxpayer with a monitored installment agreement they will receive Notice CP 523 Defaulted Installment Agreement Notice of Intent to Levy.

Editable Security Deposit Demand Letter Massachusetts Fill Online Demand Security Deposit Le Letter Templates Lettering Letter Form

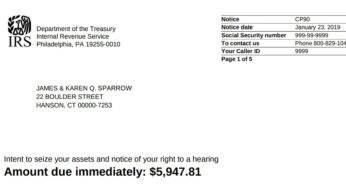

This letter serves as the first reminder that you owe money to the IRS.

Why would the irs send me a certified letter. Some IRS notices are sent via certified mail such as the Notice of Intent to Levy while others are mailed via regular post like changes made to your tax return. A certified letter could mean the IRS has finally gotten around to choosing you. Based on what you have told me about the amount you owed them and the fact that you were gone for 3 months before finally getting around to paying the amount due that is more than.

Collection Letters That Result in a Certified Letter from the IRS. Generally speaking the IRS sent you certified mail to show it attempted to give you notice of whatever issue the IRS wants to address with you. IRS Mostly an IRS computer automatically sends IRS letters including certified mail.

The IRS sent you certified mail because the IRS wants to protect itself in case among other reasons you argue the IRS failed to give you notice and an opportunity to a hearing. This letter from the IRS is also common. In many cases the IRS will send a letter simply asking for additional information or clarification of details listed on your tax return.

Why was I notified by the IRS. An IRS audit letter will come to you by certified mail. Whether you owe the IRS a lot of money or a little amount of money they will generally send you a certified letter to your address.

I was alarmed this week when a friend shared a seemingly innocent-looking CP2000 notice from the Internal Revenue Service in Austin. You have a balance due. The government will give you 30 days to contact them to settle your delinquent tax debtThe longer you wait more letters will follow.

The reason they send the letter by a certified carrier is to have legal proof that they sent you a notice on a certain date and to your address of record. Unless its because ive ordered something from over seas and have to sign for it a registeredcertified letter usually gets the uh oh response. The letter concerned a prior-year income tax change in the amount of 32500.

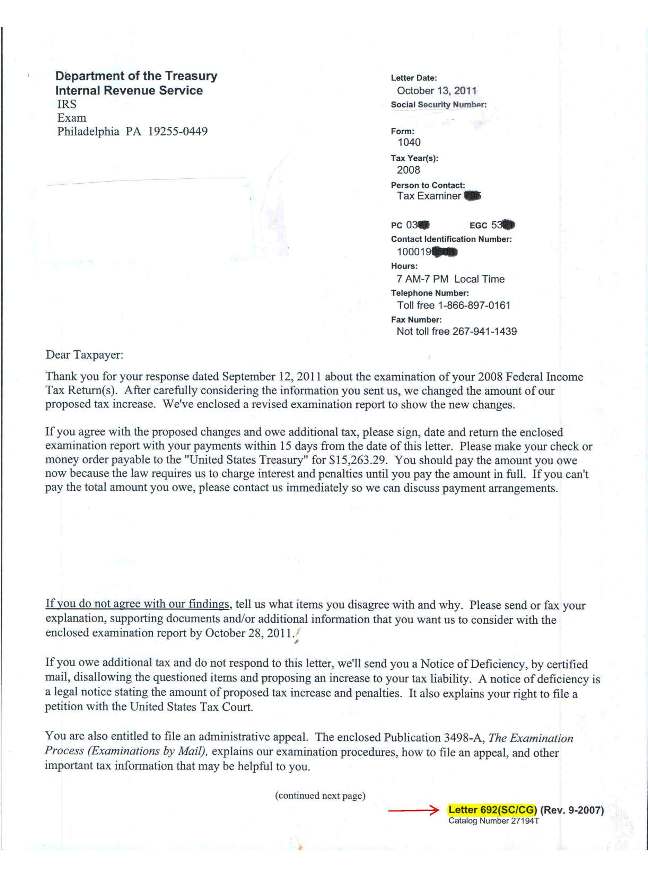

IRS sends certified mail to tell you that your audit has ended up with you owing money and you have to either go to Tax Court within 90 days or your are going to get a bill OR you have a delinquent tax liability and if you dont promptly pay it or make other arrangement that are satisfactory to IRS it is going to collect the account by levy on your assets. Sometimes if the IRS assigned an IRS employee to work on your case this IRS employee may manually send you a letter through certified mail. The reason the mail is sent certified is because its proof that the mail was delivered.

Now about the above letter. This letter from the IRS notifies the spouse of a taxpayer that the tax return is overdue or there is a tax amount owed. IRS Letter that is a Second Reminder Notice that includes spousal notification.

You were audited and the IRS mailed you a certified letter which is known as a notice of deficiency. Similar QuestionsDoes IRS send certified letters for auditHow is certified mail delivereWhat does a certified letter meaWhich is better registered or certified maiAre there fake IRS letterWhat types of letters does the IRS senWhat does it mean when certified mail is unclaimeIs a certified letter bad newWhy am I getting a certified letter from the. You are due a larger or smaller refund.

Read all IRS letters and notices you receive both certified and via regular mail. Your letter will also reveal the primary focus of the audit and what documentation you need to provide to resolve it. The IRS does not have to bring you to Court and obtain a judgment against you in order to take action against you.

Whats inside the envelope is a letter that will talk about taxes due or returns that havent been filed. The most common cause for a letter from the IRS is a mistake on your tax return. The irs will not send these notices by email or contact you by phone.

668Y This is an official Notice of Tax Lien. If you have received a certified letter fro. And you probably dont feel so lucky right about now.

Typically the IRS will not send a certified letter for notice of an audit unless they had previously tried to contact you through regular mail and had no response. The reason this IRS notice is certified is because the IRS must wait 90 days from the date of its mailing 150 days if you reside outside the US to assess the additional tax the IRS says you should owe. The irs will not send these notices by email or contact you by phone.

Rather the IRS certified letter is the only legal action that needs to be taken in order to levy your bank account or levy your wages. The IRS sends notices and letters for the following reasons. The reason is that the IRS has too many taxpayers and too few officers agents and employees so they have to really pick and choose whom they go after.

The CP2000 is how the IRS notifies taxpayers of a change to their tax account. Certified letter from irs why sent mail received a notice from the irs or department of revenue here s what you need to do sacco tax beware fake irs letters are making the rounds this summer why would i get a certified letter from the irs irs letter 4464c sample 2 get a certified letter from the irs what it means reliance tax group. There are many reasons why the IRS would send the letter or notice by certified mail.

We have a question about your tax return. Do not ignore any of them. The best way to avoid negative letters from the IRS is to file your tax returns accurately and on time.

If the IRS is sending you certified mail theyre validating that you exist at that address. The IRS will not send these notices by email or contact you by phone.

Free Sample Of Business Letter And Format Cover Letters Examples Letter Writing Guide L Business Letter Template Collection Letter Business Letter Sample

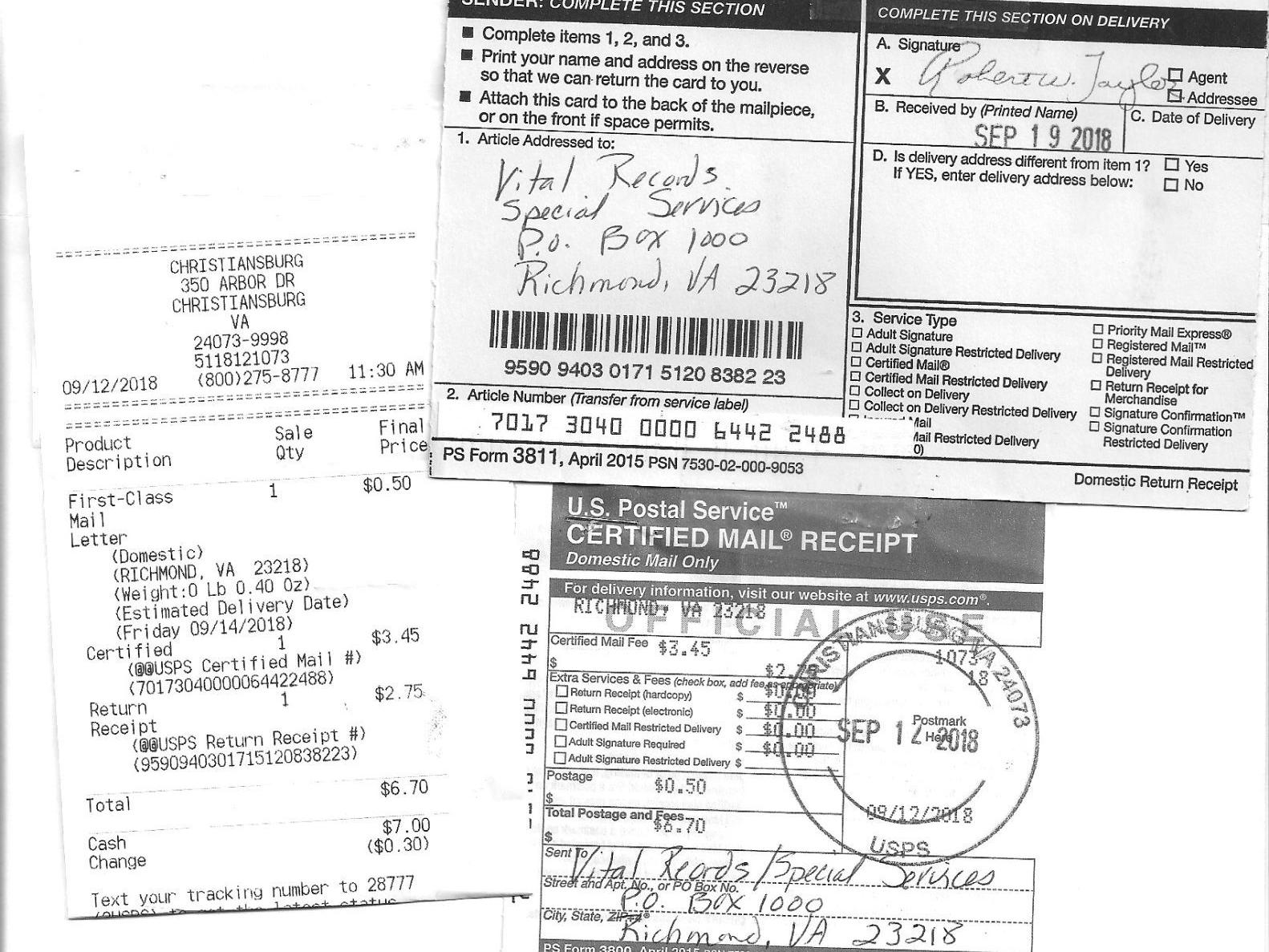

Proof Of Mailing Tax Documents When Irs Cannot Sign For Delivery

Cover Letter Template College Student College Cover Coverlettertemplate Letter Student Cover Letter For Resume Cover Letter Example Cover Letter Sample

Can You Refuse Certified Mail Certified Mail Labels

Free Resume Templates Human Services Resume Examples Human Resources Resume Teacher Resume Examples Cover Letter For Resume

Demand Letter For Money Owed Inspirational How To Write A Letter Demand Sample Format Letter Templates Free Letter Templates Business Letter Template

Should I Mail My Irs Or State Tax Payment By Certified Mail

Casey Christiansburg Mom Hopes Son S Birth Certificate Truly Is In The Mail Local News Roanoke Com

Payment Demand Letter Template Addictionary Throughout Payoff Letter Template In 2021 Letter Templates Free Letter Templates Payoff Letter

Lawyer Shows How To Respond To Irs Letters 525 692 1912

Sample Breach Of Settlement Agreement Damages Inspirational 17 Workers Compensation Settlemen Resume Writing Services Resume Examples Resume Objective

Sample Cover Letters For Nurses Best Of Certified Nursing Assistant Coverletter Sample Nursing Cover Letter Cover Letter Template Free Nurse Cover

How To Send Certified Mail Youtube

The Irs Announced That It Is Lowering From 85 To 80 The Amount Taxpayers Are Required To Have Paid In Order To Escape An Un Tax Refund Irs Federal Income Tax

Irs Audit Letter What An Irs Letter Looks Like How To Respond

What Is An Enrolled Agent Enrolled Agent School Adventure Business Tax